Step-by-step instructions on integrating international payment gateways and implementing currency

In this tutorial, we will provide a comprehensive guide, consisting of step-by-step instructions, on how businesses can successfully integrate international payment gateways and implement currency functionality. By following these guidelines, businesses can navigate the complexities of international e-commerce, overcome barriers to cross-border transactions, and create a seamless and inclusive shopping experience for customers worldwide.

- By

- 1318 views

- 0 reply

TABLE OF CONTENTS

"I Knew My Store Could Do Better...

But I Didn't Know How"

That's what one of our clients, Jessica, told us. She was running a small mug store on WooCommerce—sales were okay, but stuck.

Until she discovered personalization.

Until she discovered Cmsmart.

Fast-forward 30 days:

- ✅ Her store was redesigned with AI product options

- ✅ Customers could design their own mugs with 3D preview

- ✅ AOV jumped by 42% — and she finally felt in control

Want to learn how she did it (and how you can too)?

🎓 Join our FREE 30-Day Email Course:

"Personalize, Launch & Scale – The Smart Ecommerce Way"

You'll get:

- ✔ 1 lesson a day, straight to your inbox

- ✔ Real store examples, demos & playbooks

- ✔ No tech jargon. Just strategy that works.

Join thousands of store owners learning how to scale smarter.

🎉 You're In! Thank You!

We've received your information and you're now part of our smart ecommerce journey.

Please check your inbox – your first email from the 30-Day Course is on its way!

📩 Didn't see it? Check your spam or promotions tab and mark us as safe.

We're excited to help you personalize, launch, and scale your store – the smart way.

TABLE OF CONTENTS

Related Post

Did you know that eCommerce sales are projected to reach a staggering $8 trillion by 2027? In a world where high transaction fees and limited flexibility can cripple potential...

Imagine doubling your conversion rates simply by understanding and implementing the latest trends in eCommerce - sounds exciting, right? In a 2022 report, it was highlighted that the global...

Introduction: The Power of Custom Stickers for SMEs In today’s dynamic ecommerce landscape, custom stickers have emerged as a powerful tool for small and medium-sized enterprises (SMEs) to stand out,...

Other Usefull Contents

You can see many success stories from our customers, and you may be one of them in the future

In today's interconnected world, international e-commerce has emerged as a game-changer for businesses. The advent of technology and the internet has opened up new horizons, enabling companies to transcend geographical boundaries and tap into a global customer base. However, expanding into international markets comes with its own set of challenges, particularly when it comes to payment processing and currency conversion. To overcome these hurdles and seize the opportunities presented by international e-commerce, businesses must prioritize the integration of international payment gateways and the implementation of currency functionality.

Integrating international payment gateways is essential for businesses looking to establish a seamless payment infrastructure that caters to customers from around the world. These gateways act as intermediaries, securely facilitating the transfer of funds between customers and businesses during online transactions. By integrating a reliable payment gateway, businesses can not only ensure the security of transactions but also provide customers with a range of payment options, including credit cards, digital wallets, and local payment methods. This flexibility not only enhances the customer experience but also increases the likelihood of completing sales, as customers are more likely to proceed with a purchase when presented with their preferred payment method.

Learn more: How To Build An Ecommerce Mobile App

What are payment gateways?

Payment gateways are online platforms or services that facilitate the secure transfer of funds between customers and businesses during online transactions. They act as intermediaries between the customer's financial institution (such as a bank or credit card company) and the merchant's bank account. Payment gateways play a crucial role in ensuring that transactions are processed securely, efficiently, and in compliance with industry standards and regulations.

When a customer makes a purchase on an e-commerce website or any online platform, the payment gateway securely collects the customer's payment information, such as credit card details or digital wallet credentials. It then encrypts and transmits this information to the appropriate financial institutions for authorization and payment processing. Once the payment is authorized, the payment gateway communicates the transaction status back to the merchant and facilitates the transfer of funds to the merchant's bank account.

Payment gateways offer various features and services to streamline the payment process, including fraud detection and prevention measures, recurring billing options, and integration with popular payment methods like credit cards, debit cards, digital wallets, and bank transfers. By integrating a payment gateway into their online platforms, businesses can provide customers with a seamless and secure payment experience, ultimately driving sales and establishing trust and credibility with their customers.

Top of popular international payment gateways

PayPal

PayPal is one of the most widely used payment gateways globally. It supports payments in multiple currencies and offers a user-friendly interface for both customers and merchants. PayPal also provides buyer and seller protection, fraud detection, and integration with various e-commerce platforms.

Pros:

Wide Acceptance: PayPal is one of the most widely accepted online payment platforms globally. It is available in over 200 countries and supports transactions in multiple currencies. This wide acceptance makes it convenient for analysts to conduct business transactions with clients or customers worldwide.

Security: PayPal offers robust security measures to protect users' financial information and transactions. It uses advanced encryption technology to safeguard sensitive data and employs fraud monitoring systems to detect and prevent fraudulent activities. Additionally, PayPal provides buyer and seller protection programs, which offer recourse in case of unauthorized transactions or disputes.

Convenience: PayPal offers a convenient and user-friendly platform for analysts to send and receive payments. It eliminates the need for sharing sensitive financial information, such as credit card details, with the other party. Analysts can simply link their PayPal account to their bank account or credit card and make transactions with just a few clicks.

Integration: PayPal can be easily integrated into various e-commerce platforms, making it seamless for analysts to accept payments from clients or customers. It offers developer tools and APIs that allow for smooth integration with websites, online marketplaces, and mobile apps. This integration capability simplifies the payment process and enhances the overall user experience.

Mobile-Friendly: PayPal provides a mobile app that allows analysts to manage their transactions on the go. The app enables users to send or request money, check their account balance, view transaction history, and receive notifications. This mobile accessibility is particularly beneficial for analysts who frequently work remotely or need to make payments while on the move.

Cons:

Fees: PayPal charges fees for certain types of transactions. For example, there are fees associated with receiving payments for goods and services, transferring funds internationally, or converting currencies. These fees can vary based on factors such as transaction amount, country, and payment method. For analysts who frequently make transactions or deal with international clients, these fees can add up and impact profitability.

Account Holds: PayPal has a policy of holding funds in certain situations to mitigate potential risks, such as fraud or disputes. This can be inconvenient for analysts who rely on immediate access to their funds. Although the hold period is typically short-term, it can still cause delays in cash flow and affect the smooth operation of an analyst's business.

Limited Customer Support: Some users have reported difficulties in reaching PayPal's customer support. While PayPal offers customer service through phone, email, and an online help center, the response time and effectiveness of support can vary. Analysts who encounter issues or disputes may find it frustrating if they are unable to promptly resolve their concerns.

Limited Privacy: To use PayPal, users are required to link their account to a bank account or credit card. This means sharing personal financial information with PayPal. While PayPal has strong security measures in place to protect this data, some analysts may have concerns about privacy and the potential risk of their financial information being compromised.

Account Freezes: In certain cases, PayPal may freeze or limit an account if they suspect fraudulent activity or violation of their terms of service. While this is done to protect users and maintain the integrity of the platform, it can cause significant disruptions for analysts who rely on PayPal for their transactions. Account freezes can result in temporary loss of access to funds and require time-consuming efforts to resolve the issue.

Adyen

Adyen is a global payment gateway that supports payments in over 200 countries and 250 payment methods. It offers features like dynamic currency conversion, fraud prevention, and recurring billing.

Pros:

Global Reach: Adyen is a global payment platform that supports transactions in over 150 currencies and provides access to various payment methods. This wide reach allows analysts to conduct business internationally and cater to a diverse customer base.

Seamless Integration: Adyen offers robust integration capabilities, allowing analysts to easily integrate the payment platform into their websites, mobile apps, or other e-commerce platforms. The platform provides developer-friendly APIs and SDKs, making it convenient for analysts to customize and tailor the payment experience to their specific needs.

Advanced Fraud Protection: Adyen employs sophisticated fraud prevention tools and technologies to detect and mitigate fraudulent activities. It utilizes machine learning algorithms and real-time data analysis to identify suspicious transactions, helping to minimize the risk of chargebacks and unauthorized payments.

Comprehensive Reporting and Analytics: Adyen provides detailed reporting and analytics features that enable analysts to gain insights into their transaction data. The platform offers real-time reporting, transaction-level data, and customizable dashboards, allowing analysts to monitor payment performance, track trends, and make data-driven business decisions.

Multi-channel Support: Adyen supports various sales channels, including online, mobile, in-store, and omnichannel. This flexibility allows analysts to provide a seamless payment experience across different touchpoints, enhancing customer satisfaction and increasing conversion rates.

Cons:

Complex Pricing Structure: Adyen's pricing structure can be complex and may involve different fees, such as transaction fees, processing fees, and monthly fees. The specific pricing details can vary based on factors such as transaction volume, currency, and payment method. Analysts should carefully review and understand the pricing structure to determine the overall cost and feasibility for their business.

Limited Customer Support: Some users have reported challenges in reaching Adyen's customer support. While Adyen offers support through various channels, such as email, phone, and a knowledge base, the response time and effectiveness of support may vary. Analysts who encounter issues or require assistance may find it frustrating if they are unable to promptly resolve their concerns.

Customization Complexity: While Adyen provides extensive customization options, some analysts may find the setup and configuration process complex and time-consuming. The platform's flexibility and advanced features may require technical expertise or additional resources for implementation, which can be a challenge for smaller or less tech-savvy analyst teams.

Limited Availability: Adyen's availability is subject to geographic restrictions. While the platform supports transactions in many countries, it may not be available in certain regions or for specific payment methods. Analysts operating in niche markets or targeting customers in regions where Adyen is not supported may need to consider alternative payment solutions.

Learning Curve: Adyen's extensive suite of features and functionalities may have a learning curve for analysts who are new to the platform. Understanding and utilizing the full potential of Adyen's capabilities may require time and training, especially for analysts who are transitioning from other payment platforms.

PayU

PayU is a leading payment gateway that operates in various countries across Europe, Latin America, and Asia. It supports payments in multiple currencies and offers features like one-click payments, tokenization, and fraud detection.

Pros:

Global Presence: PayU is a leading online payment service provider with a strong global presence, operating in more than 50 countries. This wide reach allows analysts to conduct business transactions internationally and cater to a diverse customer base.

Multiple Payment Options: PayU supports multiple payment methods, including credit cards, debit cards, bank transfers, and digital wallets. This variety of payment options enables analysts to offer flexibility to their customers and enhance the overall user experience.

Easy Integration: PayU offers easy integration options, providing APIs and plugins that allow analysts to seamlessly integrate the payment platform into their websites, mobile apps, or e-commerce platforms. This simplifies the payment process and ensures a smooth checkout experience for customers.

Security and Fraud Protection: PayU prioritizes security and implements robust fraud prevention measures. It employs advanced encryption technology, tokenization, and secure payment gateways to protect sensitive data and prevent fraudulent activities. PayU's risk management tools help analysts detect and mitigate potential risks associated with online transactions.

Localized Solutions: PayU offers localized payment solutions in various countries, allowing analysts to provide payment options that are tailored to specific regions and customer preferences. This localization can help improve customer trust and increase conversion rates.

Cons:

Limited Availability: While PayU operates in numerous countries, its availability may be limited in certain regions or for specific payment methods. Analysts targeting customers in regions where PayU is not supported may need to consider alternative payment solutions or find ways to accommodate local payment preferences.

Transaction Fees: PayU charges transaction fees for processing payments. The specific fees can vary based on factors such as transaction volume, currency, and payment method. Analysts should carefully review and understand the pricing structure to determine the overall cost and feasibility for their business.

Limited Customization Options: Some analysts may find that PayU's customization options are limited compared to other payment service providers. Customizing the payment experience to match the brand's look and feel or integrating additional features may not be as flexible as desired.

Customer Support: While PayU provides customer support, some users have reported challenges in reaching their support team or experiencing delays in response times. Analysts who require assistance or encounter issues may find it frustrating if prompt support is not readily available.

Learning Curve: For analysts who are new to PayU, there may be a learning curve associated with understanding the platform's functionalities and features. This may require time and training to fully utilize PayU's capabilities and optimize the payment process.

Payoneer

Payoneer is a widely-used payment gateway that specializes in cross-border payments. It supports payments in over 200 countries and offers features like global bank transfers, prepaid Mastercard, and multiple currency accounts.

Pros:

Global Reach: Payoneer is a global payment platform that allows analysts to receive payments from clients or customers worldwide. It supports transactions in over 150 currencies and provides access to various payment methods, making it convenient for analysts to conduct business internationally.

Secure and Reliable: Payoneer prioritizes security and employs robust measures to protect user data and transactions. It implements encryption technology, two-factor authentication, and anti-fraud systems to ensure the safety of sensitive information. Payoneer is also a regulated financial institution, providing added reliability and trust.

Easy Withdrawal: Payoneer offers multiple withdrawal options, including bank transfers, prepaid Mastercards, and local currency transfers. This flexibility allows analysts to access their funds conveniently and choose the most suitable method based on their location and preferences.

Integration with Marketplaces: Payoneer has partnerships with various online marketplaces, such as Amazon, Upwork, and Airbnb. This integration allows analysts to receive payments directly from these platforms, streamlining the payment process and eliminating the need for additional transfers or conversions.

Multi-Currency Accounts: Payoneer provides multi-currency accounts, allowing analysts to hold and manage funds in different currencies. This feature is beneficial for those who frequently deal with international clients or need to handle transactions in various currencies without the hassle of currency conversions.

Cons:

Fees: Payoneer charges fees for certain transactions and services. These may include withdrawal fees, currency conversion fees, and annual account maintenance fees. Analysts should carefully review and understand the fee structure to assess the overall cost and determine if it aligns with their financial goals.

Customer Support: Some users have reported challenges in accessing timely and effective customer support from Payoneer. While Payoneer offers support through various channels, such as email, phone, and an online help center, the response time and quality of support may vary. Analysts who require assistance may find it frustrating if they encounter delays or difficulties in resolving their concerns.

Limited Accessibility: Payoneer may not be available in all countries or for certain industries. Analysts operating in regions where Payoneer is not supported may need to explore alternative payment solutions or find ways to accommodate local payment preferences.

Account Holds: Payoneer may place holds on funds in certain situations, such as when there are security concerns or compliance issues. While this is done to mitigate risks, it can cause delays in accessing funds and impact cash flow for analysts who rely on immediate access to their payments.

Currency Conversion Rates: Payoneer's currency conversion rates may not always be the most competitive compared to other currency exchange platforms. Analysts who frequently deal with currency conversions should assess the rates and consider alternative options if more favorable rates are available elsewhere.

Amazon Pay

Amazon Pay is a payment gateway offered by Amazon that allows customers to use their Amazon account to make payments on external websites. It provides a seamless checkout experience and offers features like fraud protection and integration with Amazon's customer data.

Pros:

Trusted Brand: Amazon is a well-known and trusted brand worldwide. Utilizing Amazon Pay as an analyst can provide a sense of security and familiarity to customers, which may increase conversion rates and customer trust.

Seamless Integration: Amazon Pay offers easy integration with various e-commerce platforms, making it convenient for analysts to implement the payment solution on their website or mobile app. The platform provides developer tools and APIs that simplify the integration process and ensure a smooth checkout experience for customers.

Streamlined Checkout: Amazon Pay allows customers to use their existing Amazon account credentials to make purchases, eliminating the need to enter payment and shipping information manually. This streamlined checkout process can reduce friction and enhance the user experience, potentially leading to higher conversion rates.

Mobile-Friendly: Amazon Pay is optimized for mobile devices, allowing analysts to provide a seamless payment experience to customers who prefer to shop on their smartphones or tablets. The mobile-friendly interface ensures a smooth and user-friendly checkout process, which is crucial in today's mobile-driven market.

Trust and Security: Amazon Pay leverages Amazon's robust security infrastructure and fraud detection systems to protect customer data and ensure secure transactions. Customers may feel more confident using Amazon Pay, knowing that their payment information is backed by Amazon's trusted security measures.

Cons:

Limited Availability: Amazon Pay may not be available in all countries or for all industries. Analysts operating in regions where Amazon Pay is not supported or targeting customers in industries where it is not widely adopted may need to consider alternative payment solutions.

Transaction Fees: Amazon Pay charges transaction fees for each processed payment. The specific fees can vary based on factors such as transaction volume and the country in which the transaction occurs. Analysts should carefully review and understand the fee structure to assess the overall cost and determine if it aligns with their financial goals.

Limited Customization: Some analysts may find that Amazon Pay's customization options are limited compared to other payment solutions. Customizing the payment experience to match the brand's look and feel or integrating additional features may not be as flexible as desired.

Customer Data Ownership: When customers use Amazon Pay, their payment and order data are stored and owned by Amazon. This may limit analysts' access to customer data for marketing or customer relationship management purposes. Analysts should consider this aspect if customer data ownership is a critical factor in their business strategy.

Customer Support: While Amazon offers customer support for Amazon Pay, some users have reported challenges in reaching their support team or experiencing delays in response times. Analysts who require assistance or encounter issues may find it frustrating if prompt support is not readily available.

Factors to consider when choosing an international payment gateway

When choosing an international payment gateway, there are several factors to consider to ensure it aligns with your business requirements. Here are some key factors to consider:

Integration Options: Consider the ease of integration with your e-commerce platform or website. Look for payment gateways that offer plugins, APIs, or ready-made integrations with popular platforms like Shopify, WooCommerce, Magento, or custom-built solutions if needed. A smooth integration process will save you time and resources.

Ease of use: Consider the user interface and overall user experience of the payment gateway, both for you as the merchant and for your customers.

Customer support: Look for a payment gateway that offers reliable customer support, with multiple channels of communication and quick response times.

Reputation and reviews: Research the reputation of the payment gateway provider and read reviews from other merchants to ensure their reliability and trustworthiness.

Scalability: Consider whether the payment gateway can handle your business's growth and accommodate increased transaction volumes.

Additional features: Look for any additional features offered by the payment gateway, such as recurring billing, subscription management, or multi-language support, that may be relevant to your business needs.

Compatibility with mobile devices: Ensure that the payment gateway is optimized for mobile devices, as an increasing number of customers are making purchases through mobile devices.

PCI compliance: Verify that the payment gateway is Payment Card Industry Data Security Standard (PCI DSS) compliant to ensure the security of credit card data.

Step-by-Step Instructions for Integrating International Payment Gateways

Integrating international payment gateways can vary depending on the specific payment gateway provider and the platform you are using for your website or application. However, here is a general step-by-step guide to help you get started:

Research and Select a Suitable Payment Gateway:

Understand Your Needs and Markets: Define your business requirements, transaction volume, and the countries you want to target. Identify the preferred payment methods of your target customers.

Research Gateways: Explore payment gateways that handle international transactions, offer strong market presence in your target regions, and support the currencies you need. Check their reputation and features.

Compare Features and Costs: Evaluate payment gateways for multi-currency support, integration options, security, and pricing. Consider transaction fees, setup costs, and additional charges.

Verify Compatibility: Ensure the gateway supports your target countries and integrates smoothly with your platform using plugins or APIs. Look for developer support and detailed documentation.

Assess Security: Prioritize gateways with robust security measures like encryption, fraud detection, and PCI DSS compliance to protect customer data.

Focus on User Experience: Choose gateways offering mobile-friendly interfaces, seamless checkouts, and diverse payment options for both you and your customers.

Check Customer Support: Opt for providers with reliable 24/7 support, live chat, or dedicated account managers to resolve issues promptly.

Read Reviews and Recommendations: Research reviews, testimonials, and case studies to understand user experiences. Seek advice from trusted sources or peers.

Make Your Choice: Select a gateway that aligns with your business needs, supports your markets, and offers reliable features, security, and cost-effectiveness. Ensure it complements your overall business model.

Sign up and Create an Account with The Chosen Payment Gateway

By following these steps, you'll ensure a smooth setup and integration of your payment gateway.

Configure The Payment Gateway Settings:

These steps ensure a seamless payment gateway integration, enabling secure and reliable transactions on your e-commerce platform.

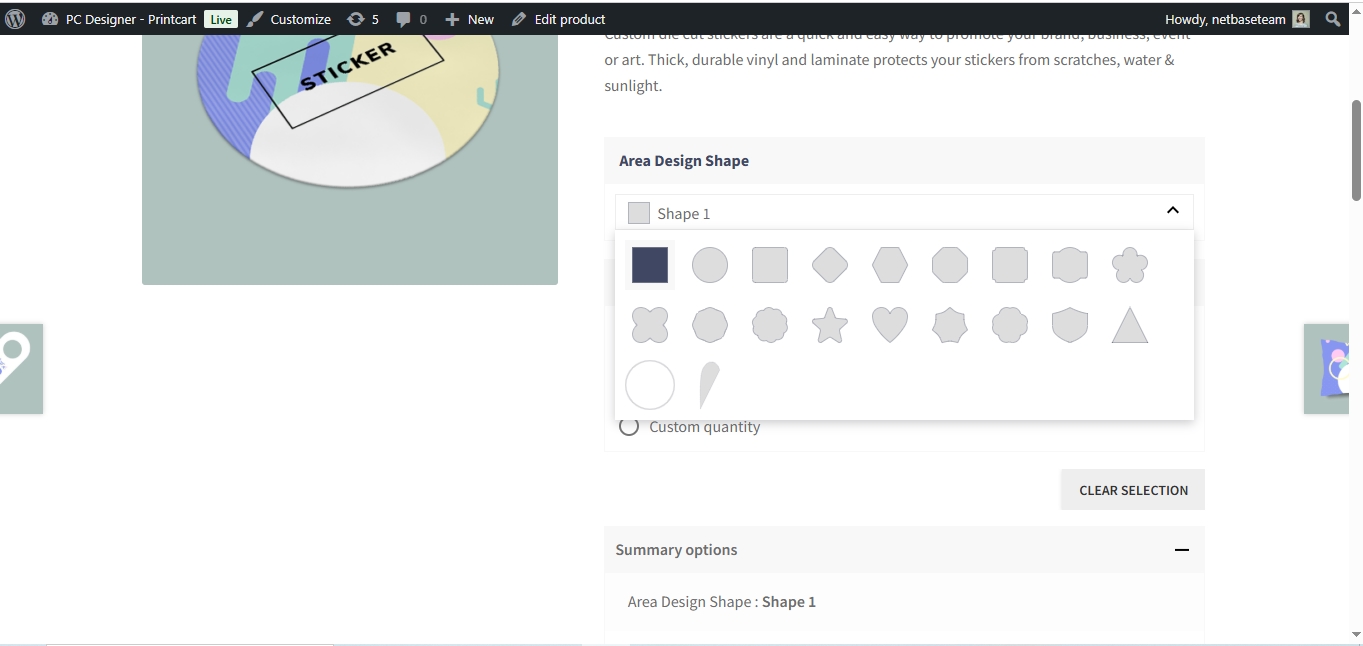

Integrate The Payment Gateway with Your E-commerce Platform:

Determine the Integration Method: Identify the integration method compatible with your payment gateway and platform. Options may include API integration, hosted payment pages, or ready-made plugins/extensions specific to your e-commerce platform.

Log in to the Admin Panel: Access the admin dashboard of your e-commerce platform using your credentials. This is where you manage the configurations for payment setup and other store functions.

Locate Payment Settings: Navigate to the section labeled "Payment Settings" or "Payment Gateway" within the admin panel. This is typically under "Settings" or a similar menu, depending on the platform.

Select Your Payment Gateway: From the available list of payment gateways, choose the one you’ve signed up with. Ensure it aligns with your business needs and supports the regions and currencies you’re targeting.

Enter Your Payment Credentials: Input the required credentials provided by your payment gateway, such as API keys, merchant IDs, or secret keys. These details can typically be found in your gateway account’s integration or API settings.

Configure Integration Settings: Adjust additional integration settings to match your business requirements. This may include:

Test the Integration: Use the payment gateway’s sandbox or test mode to simulate transactions. Test various scenarios such as different payment methods, currencies, and order amounts. Verify that transactions are accurately processed and logged in both your gateway account and platform.

Switch to Live Mode: After successful testing, enable live mode in your payment gateway settings. This allows your store to process real transactions. Update your e-commerce platform with the live integration details if needed.

Conduct Live Transaction Testing: Perform low-value live transactions to confirm the integration’s functionality. Test multiple payment methods and currencies to ensure smooth operation.

Monitor and Maintain the Integration: Regularly check the integration for updates from your payment gateway or e-commerce platform. Monitor transaction logs and customer feedback to identify and address any issues promptly. Stay informed about changes in gateway features or security updates.

Test Additional Features (if applicable): Some gateways offer advanced functionalities like recurring billing, fraud prevention tools, or multi-currency displays. Configure and test these features as needed to enhance your payment processing capabilities.

Hybrid approach: Depending on your business needs, you may opt for a hybrid approach that combines different currency conversion methods. For example, you could use a payment gateway's conversion for smaller transactions and rely on a third-party service or your bank for larger transactions to get more favorable rates. This approach allows you to balance convenience, accuracy, and cost-effectiveness based on transaction values.

Consider The Impact of Currency Conversion on Pricing and Checkout Process:

Currency conversion plays a critical role in international e-commerce. Here’s what to consider:

Pricing Consistency: Ensure consistent pricing across currencies by applying proper rounding rules, decimals, and regional formatting. Inconsistent pricing can confuse customers and lead to abandoned carts.

Exchange Rate Updates: Use real-time or regularly updated exchange rates to avoid discrepancies between displayed prices and the final charges, preventing customer dissatisfaction.

Transparency on Fees: Clearly communicate any conversion fees during checkout. Transparent pricing builds trust and reduces cart abandonment.

Currency Selection and Display: Offer easy currency selection through dropdowns or auto-detection. Display consistent prices in the chosen currency across the site to enhance clarity and convenience.

Localization: Show prices in local currencies and use region-specific formats. This personalizes the shopping experience and strengthens customer trust.

Checkout Summaries: Provide a clear summary at checkout, including the base price, exchange rate, fees, and final amount. Transparency ensures confidence in the transaction.

Testing and Updates: Regularly test and update currency conversion to ensure accurate calculations and a smooth checkout process. Address feedback promptly to maintain customer satisfaction.

By managing these factors effectively, you can enhance the shopping experience, boost conversions, and build customer trust in your international e-commerce platform.

Implementing Currency Conversion Tools and APIs in E-commerce:

Choose a Provider: Research currency conversion providers like Open Exchange Rates, XE.com, or Fixer.io. Consider accuracy, reliability, pricing, and ease of integration.

Obtain an API Key: Sign up with your chosen provider and get an API key. This unique key allows your platform to access the provider's currency data.

Integrate the API: Use the provider's documentation, SDKs, and code samples to integrate the API into your e-commerce platform. Follow their guidelines for authentication and API requests.

Fetch Exchange Rates: Retrieve real-time exchange rates using the provider’s API endpoints. Save the rates in your platform’s database or cache for future use.

Implement Conversion Logic: Use the fetched rates to calculate converted amounts during transactions. Clearly display the converted prices and any related fees at checkout.

Update Exchange Rates Regularly: Automate the process of fetching updated rates to maintain accuracy. Use webhooks or scheduled tasks to sync rates periodically.

Test Thoroughly: Validate the conversion functionality by testing transactions with various currencies. Address edge cases, like rounding issues, and ensure reliable performance.

By integrating and maintaining a currency conversion API, you can provide accurate, real-time conversions, enhancing the shopping experience for your global customers.

Start Integrating the payment gateway in your e-commerce website with CMSMART!

To facilitate smooth transactions across different currencies with CMSMART, you can follow these steps.

First, research and choose international payment gateways that align with your target countries and currencies. Sign up for an account with the selected payment gateway and complete any necessary verification.

Next, enable the payment gateway integration within CMSMART using available plugins or built-in integrations. Configure the payment gateway settings by entering the required credentials and API keys.

To ensure seamless transactions, implement currency conversion functionality by integrating a currency conversion API or service. This allows you to retrieve real-time exchange rates, calculate converted amounts, and display them to customers during the checkout process.Thoroughly test the integration to ensure that all transactions are processed smoothly without errors. Test scenarios should include multiple currencies, various payment methods, and edge cases such as failed transactions or refunds.

After testing, provide clear instructions on your website to guide customers through the payment process. Highlight supported currencies, accepted payment methods, and security measures in place to build trust and confidence among users. Consider adding features like email confirmations or order tracking to enhance the customer experience post-purchase.

Finally, monitor transaction data and customer feedback regularly to optimize the payment process. With CMSMART’s support and powerful tools, your ecommerce website can deliver a seamless and secure payment experience, catering to a global audience with ease.

Don't miss out on the immense potential of e-commerce. Join forces with CMSMART, the industry-leading provider of e-commerce website & app development. Trust our experience, leverage our credibility, and let us propel your business to new heights of success. Contact us now to embark on an extraordinary mobile journey!